Personal Loan App: Apply for Online Loan- PaySense 3.7.11

Free Version

Publisher Description

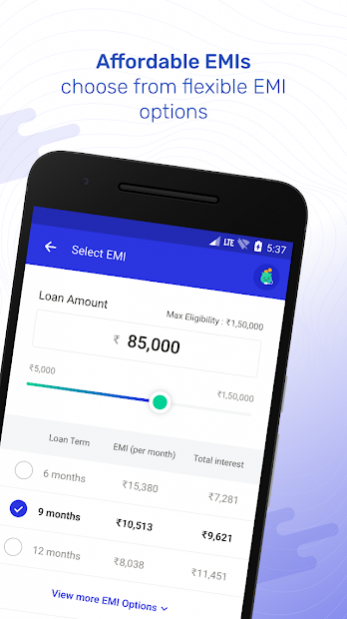

PaySense provides instant personal loans from Rs 5,000 upto Rs. 5,00,000 with an Annual Percentage Rate (APR) on loans between 16% to 36% (on a reducing balance basis).

The loans are given for a duration of 3 months to 60 months.

Looking to get a personal loan? PaySense is a personal loan app which offers instant personal loans upto ₹5 lakhs at attractive interest rates, zero collateral & flexible EMI.

Why Choose PaySense for Instant Personal Loan

PaySense lets its customers enjoy the following advantages:

👉Affordable interest rates

👉Convenient and affordable EMIs

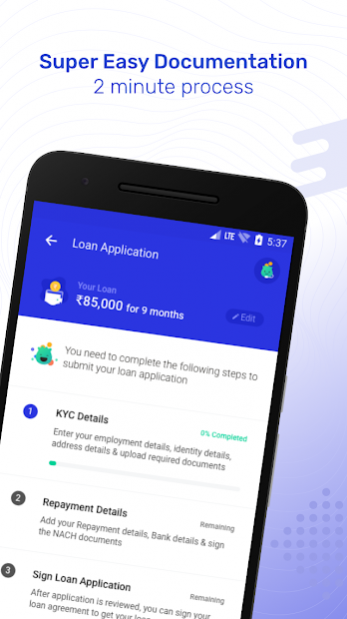

👉2-minute loan application process

👉Paperless documentation

👉Loans available for those with low credit scores as well

👉Automated updates and EMI deduction

Personal Loan App Features

👉 The standard processing fee is 2.5% of the loan amount. For example, a loan of ₹1 lakh for 24 months will have an APR of 24% (on a reducing balance basis) and a processing fee of 2.5% (₹2,500). This loan would be paid back in 24 EMIs of ₹5,391 each with the total interest of ₹29,384

It has an Equated Monthly Installment (EMI) calculator that provides the freedom of deciding your own EMI amount and loan tenure. The calculator takes into account interest, principal loan amount and tenure (duration) of your personal loan and accordingly provides the amount of money you need to pay every month and the interest payable on the loan.

Main Eligibility Criteria

👉 Salary should be more than ₹20,000 (Net monthly take home) for Mumbai & Delhi based users.

👉 Salary should be more than ₹18,000 (Net monthly take home) for Other Locations.

Additional Information

Pre-payment charges on loan closure (allowed after 3 EMI payments) is 4% +18% GST on the remaining principal amount and Late Payment Charges are ₹500 +18% GST upon failure to pay the EMI on the fixed date.

🔝💰 PaySense has been identified amongst the Top 100 Fintech innovators in the world by a KPMG and H2 Ventures report. 🔝💰

5 Million+ users have already installed the PaySense app for:

👉Personal Loan for Marriage Expenses

👉 Personal Loan for New /used Car & Two-Wheeler

👉Personal Loan for Education

👉Personal Loan for Medical Emergencies

👉Personal Loan for Consumer durable

👉Personal Loan for Credit Card Bills

👉Personal Loan for Home Renovation

👉Personal Loan for Travel

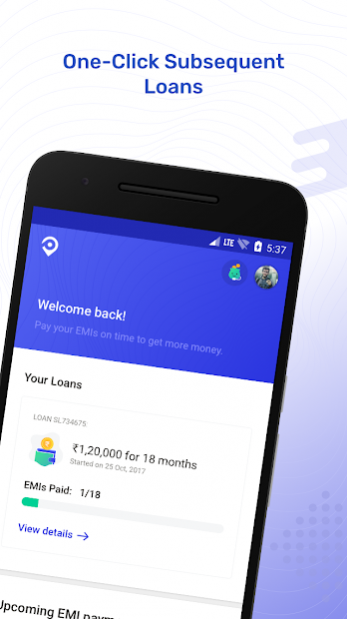

PaySense has disbursed over 1 lakh personal loans in the last 12 months and is one of the best Indian personal loan apps in the market, offering easy & quick loans to salaried individuals.

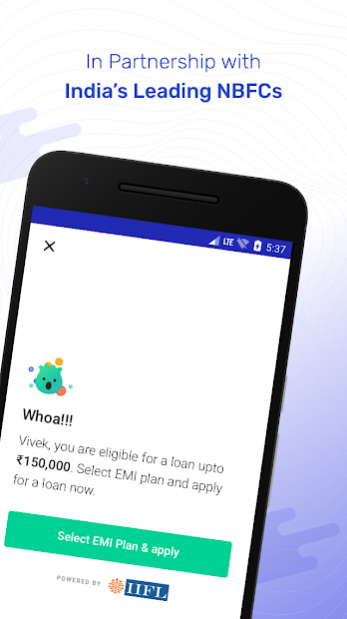

🇮🇳The company is present in 50+ cities in India, including Mumbai, Bengaluru, Kolkata, Chandigarh, Chennai, and Delhi-NCR. Paysense has partnership with India's leading NBFCs: Credit Saison India, Fullerton, IIFL, Northern Arc and PayUFinance.🇮🇳

How to Apply for Instant Personal Loan Online?

PaySense is the fastest way to get an instant personal loan online.Follow these four steps to get a loan instantly:

👉Install the PaySense online loan app.

👉Register and check your personal loan eligibility.

👉Provide KYC documentation like identity proof (Aadhar/PAN/VoterID), address proof (Aadhar/Utility bills/Rental Agreement), income proof (bank statement) and a photograph (selfie).

👉Sign application and get instant approval for your loans.

Once approved, the loan amount will be credited to your account within a few days.

Personal Loan Eligibility

You should fulfill the following criteria on the online personal loan app:

👉A resident of India

👉Between 21 to 60 years

👉A salaried employee with a min monthly salary of ₹18,000*

👉Based in any one of the 50+ cities we serve across pan-India

Security and Privacy

PaySense personal loan app ensures best security and privacy standards to protect its database. Our app is safe & secure to use and we do not share customer information with third parties without consent.

Apply and get a personal loan instantly with the safe, secure and easy to use PaySense app!

About Personal Loan App: Apply for Online Loan- PaySense

Personal Loan App: Apply for Online Loan- PaySense is a free app for Android published in the Accounting & Finance list of apps, part of Business.

The company that develops Personal Loan App: Apply for Online Loan- PaySense is PaySense Pte. Ltd.. The latest version released by its developer is 3.7.11. This app was rated by 1 users of our site and has an average rating of 5.0.

To install Personal Loan App: Apply for Online Loan- PaySense on your Android device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2021-04-07 and was downloaded 726 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the Personal Loan App: Apply for Online Loan- PaySense as malware as malware if the download link to com.gopaysense.android.boost is broken.

How to install Personal Loan App: Apply for Online Loan- PaySense on your Android device:

- Click on the Continue To App button on our website. This will redirect you to Google Play.

- Once the Personal Loan App: Apply for Online Loan- PaySense is shown in the Google Play listing of your Android device, you can start its download and installation. Tap on the Install button located below the search bar and to the right of the app icon.

- A pop-up window with the permissions required by Personal Loan App: Apply for Online Loan- PaySense will be shown. Click on Accept to continue the process.

- Personal Loan App: Apply for Online Loan- PaySense will be downloaded onto your device, displaying a progress. Once the download completes, the installation will start and you'll get a notification after the installation is finished.